Top college admin top 100k in 2006

Does anyone make hundreds of thousands of dollars a year?

We do that.

According to the annual Public Sector Salary Disclosure Act, which was initiated in 1996, 31 Fanshawe College employees made over $100 000 in 2006.

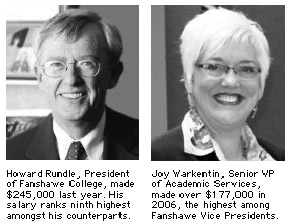

Leading the salary-pack at Fanshawe was President Howard Rundle, who earned a $245,000 in 2006.

Rundle's salary has progressively increased over the years; the 1998 results showed that Rundle made $114,125 in 1997, $160,223 in 2001 and $200,755 in 2004.

Of the 23 colleges included in the document, Rundle ranks ninth in highest salary earnings for the year. He fell behind presidents from Algonquin, Conestoga, Durham, George Brown, Humber, Sault, Seneca and Sheridan Colleges.

Durham College's President Gary Polonsky headed the list, earning a salary of $404,753 in 2006.

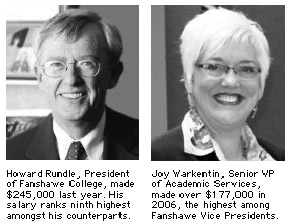

Fanshawe's Vice Presidents were all included on the list. Academic Services VP, Joy Warkentin, made $177,718, VP Student and Staff Services, Catherine Auger, made $169,029 and VP Planning and Administrative Services, Bernice Hull, earned $158,444, while VP Finance and Corporate Services, Scott Porter, made $158,444.

Also included in the 31 Fanshawe employees on the list were; Bob Beatty, Chief Information Officer, $118,120; Jeanine Buss, Registar, $115,840; Martha Grof-Iannelli, Library Services Manager $108,664; Emily Marcoccia, Marketing and Communications Manager, $106,172; among others.

Organizations that receive public funding from the Province of Ontario are required to disclose the names, positions, salaries and taxable benefits of these employees.

“The purpose of this law is to provide a more open and accountable system of government,” the Act reads. “It lets taxpayers compare the performance of an organization with the compensation given to the people running it. People paid $100,000 or more a year are usually the senior employees in an organization. It also provides taxpayers with more details on how their tax dollars are spent.”

The Act also states what is included in the $100,000 salaries.

“The $100,000 figure means salary before taxes, and does not include taxable benefits,” the Act said. “However, for those who are paid $100,000 or more, the total value of these taxable benefits must be disclosed. To make it easy for organizations to comply, the definition of salary paid and taxable benefits is identical to that on the Canada Revenue Agency T4 slip. The Act does not authorize employers to disclose what the specific benefits are.”

For a complete College salary disclosure list visit here.

We do that.

According to the annual Public Sector Salary Disclosure Act, which was initiated in 1996, 31 Fanshawe College employees made over $100 000 in 2006.

Leading the salary-pack at Fanshawe was President Howard Rundle, who earned a $245,000 in 2006.

Rundle's salary has progressively increased over the years; the 1998 results showed that Rundle made $114,125 in 1997, $160,223 in 2001 and $200,755 in 2004.

Of the 23 colleges included in the document, Rundle ranks ninth in highest salary earnings for the year. He fell behind presidents from Algonquin, Conestoga, Durham, George Brown, Humber, Sault, Seneca and Sheridan Colleges.

Durham College's President Gary Polonsky headed the list, earning a salary of $404,753 in 2006.

Fanshawe's Vice Presidents were all included on the list. Academic Services VP, Joy Warkentin, made $177,718, VP Student and Staff Services, Catherine Auger, made $169,029 and VP Planning and Administrative Services, Bernice Hull, earned $158,444, while VP Finance and Corporate Services, Scott Porter, made $158,444.

Also included in the 31 Fanshawe employees on the list were; Bob Beatty, Chief Information Officer, $118,120; Jeanine Buss, Registar, $115,840; Martha Grof-Iannelli, Library Services Manager $108,664; Emily Marcoccia, Marketing and Communications Manager, $106,172; among others.

Organizations that receive public funding from the Province of Ontario are required to disclose the names, positions, salaries and taxable benefits of these employees.

“The purpose of this law is to provide a more open and accountable system of government,” the Act reads. “It lets taxpayers compare the performance of an organization with the compensation given to the people running it. People paid $100,000 or more a year are usually the senior employees in an organization. It also provides taxpayers with more details on how their tax dollars are spent.”

The Act also states what is included in the $100,000 salaries.

“The $100,000 figure means salary before taxes, and does not include taxable benefits,” the Act said. “However, for those who are paid $100,000 or more, the total value of these taxable benefits must be disclosed. To make it easy for organizations to comply, the definition of salary paid and taxable benefits is identical to that on the Canada Revenue Agency T4 slip. The Act does not authorize employers to disclose what the specific benefits are.”

For a complete College salary disclosure list visit here.