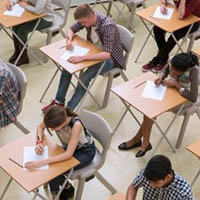

A harder program to operate than at first glance?

CREDIT: ISTOCK (ANCHIY)

CREDIT: ISTOCK (ANCHIY)Education is like a business investment, with inevitable financial risk.

This in no way is meant to berate or minimize the impact shortfalls from OSAP (Ontario Student Assistance Program) have created for some students. The inadequacies, inconsistencies and fickleness of the program are apparent, and I too have experienced its effects on my pursuit of furthering my aspirations in the past. But I digress.

Someone looking from the outside in might think that these new changes to OSAP most directly affect students of the past two years, whom were fortunate enough to take advantage of the Liberal government’s initial plan towards ‘free tuition’, and that assumption may be correct. The sentiment offered by the current government is that their intent is to ensure the sustainability of a program like OSAP for generations to come, and that these changes are necessary and due.

If one were to delve into the history of OSAP they would find that this program is a malleable one. Every few years, new changes are made that affect different earning classes and demographics, presenting a myriad of perpetual afflictions concerning debt repayment.

The discussion for free education like some of the European countries is an idealistic one, but again, one that comes with strings. Many of the countries abroad that offer free post-secondary education are more than likely able to do so because of significantly higher tax rates.

For example, in Canada, the personal income rate is roughly 33 per cent, according to the Canada Revenue Agency website, whereas in Sweden the same personal income tax rate is around 61 per cent according to tradingeconomics.com. And it isn’t just personal tax, as Canadian sales tax is 5 per cent (GST) while Sweden has a flat tax rate of 30 per cent for capital gains.

There is always a trade-off for the benefits we are fortunate or unfortunate enough to have. Taxation aside, there is also the challenge of educator to student ratios. If you consider the roughly 16 million students who attend American colleges annually according to the National Center for Education Statistics, versus the nearly 300,000 students who attend higher education in Norway according to Statistics Norway, one can quickly identify a greater challenge attending to the needs of the larger pool of students.

Take into account the fact that there are roughly 10,000 elementary schools in Canada according to Statistics Canada that don’t take tuition as a means towards offsetting operating costs. The money to keep these institutions operable come from various funds from the provincial government by way of school boards, allocated from taxpayers funds. Operating costs for these elementary schools in Ontario range from $1.1 million to $3.2 million according to the Ontario Ministry of Education website, depending on the number of enrolled students.

At the high end, that’s nearly $32 billion dollars in assistance from the government and school boards, and that is just to cover elementary schools. The math doesn’t always make sense, or always come out with the same solution, but common sense says money has to come from somewhere.

It is unfortunate to say, and indeed may be an unfavourable point of view, but there are always sacrifices made to benefit the future; at least that’s what we’ve been told. The unfortunate thing about a statement like this is when you’re living in a time where you are the sacrificial lamb that sentiment stings even more. The thing about planning for the future, an integral statement of the current government, is that despite the best of intentions, analytical predictions about the direction of society, economics and the like, we as a whole won’t know if the decisions made today will truly benefit society and those who will be in need in the future.

The knowledge of this, that the forced sacrifices made today by the ones whom are in need, does not make it any easier to digest the hurdles and potential difficulties that may be faced in the future.

Education is an investment in oneself. What if we took a look at the concept of student financial aid from the perspective of a business investor? A business investor looks for products, ideas and people that they believe in and whom they believe they can make a return on their investment. The same concept is true in regards to the Ontario government and their view of a student’s potential.

While it may not be explicitly displayed that way, the assistance that the government outlays is done so with hopes of a return that is beneficial to the investor. The interest that is collected from student loan allocation is one way in which this pound of flesh is repaid. The other way is more subvert, but a successful investment can also look like job creation by way of entrepreneurship, innovation in sciences, technology, resources and the like.

These types of returns on investment also help the nation as a whole. They can generate more jobs, saturate the economic market and essentially help Canada’s bottom line. Everything costs money, in one way or the other. Faculty and staff need to retain wages for their services. Utility bills need to be stayed on top of. Operating costs are exorbitant at post secondary institutions. It is the circle of life.

Another point to consider when observing reactions to OSAP changes is perspective. Some applicants received a lot of support while others did not receive as much as they’d hoped, but the idea of what is enough or fair, varies dependent on individual expectations. Just because we ask and hope for the moon does not mean that we will receive it.

OSAP, although a supportive tool for individuals to finance their education, is still a program that requires funding to operate. If that funding is exhausted or diluted the idea of help for all becomes an archaic concept of support from a time long ago when spoken of in the future. Awareness and consideration don’t always make dealing with perceived injustices easier but they can help soften protestations to the contrary.

The trade-off of receiving funds to help assist with educational costs comes at a premium. Having to repay loans that, if otherwise not taken, would render the opportunity to go to school difficult or impossible. Although the grant portion of your application may no longer be able to wholly take care of tuition, assistance is still readily available.

When looking at options of how one can finance higher education the list is as follows: saving, assistance from family, scholarships, bursaries, loans and grants. So while maybe not ideal, if the need, desire and drive to aspire in higher education is strong enough, than the unfavourable commitment to loan repayment may not seem as big a red flag as initially observed, especially if that option is open to you.

Editorial opinions or comments expressed in this online edition of Interrobang newspaper reflect the views of the writer and are not those of the Interrobang or the Fanshawe Student Union. The Interrobang is published weekly by the Fanshawe Student Union at 1001 Fanshawe College Blvd., P.O. Box 7005, London, Ontario, N5Y 5R6 and distributed through the Fanshawe College community. Letters to the editor are welcome. All letters are subject to editing and should be emailed. All letters must be accompanied by contact information. Letters can also be submitted online by clicking here.