Fanshawe student shares struggle to afford college life

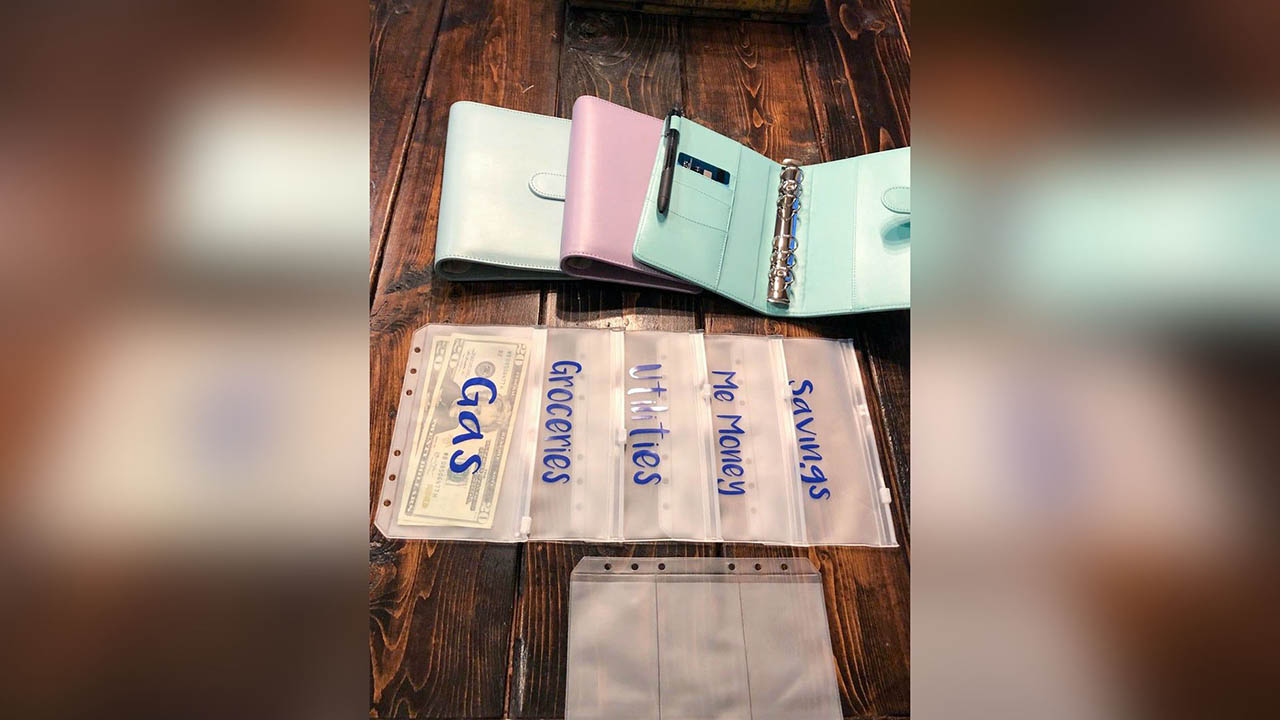

CREDIT: MIA ROSA-WAYNE

CREDIT: MIA ROSA-WAYNEAffording life as a student sometimes means making sacrifices.

In the face of escalating costs, college students are finding it harder to afford the simple things.

As the fall semester nears its end, students may find themselves yearning for the full college experience including social events, extracurricular activities alongside the academic journey.

However, being in college can be tricky when it comes to finances and wanting to live the full college experience. Whether it comes to food, housing, gas, or tuition it’s almost impossible to afford anything on your own.

Asking students how they budget in school is important to look at because students are constantly surrounded by opportunities to spend money, whether it’s an invite to the bar or an offer to grab lunch after class.

Fanshawe student Nicole Steinhoff said her past two years of budgeting while in school have been challenging.

“Paying $650 a month for rent plus groceries, gas and other expenses is extremely hard while being at school. There is no easy way to save money while being away from home and not having the extra help especially with how expensive everything is now.”

Steinhoff had to make some rules for herself to save money.

“Some things I do to help me save are not going out with friends during the week. I also walk three blocks every day because a parking pass at Fanshawe is over $600 a year and that’s only if you’re able to get one.”

The financial costs Canadian students face have only been increasing over the years.

Steinhoff explained that rent is her biggest payment while in school, and that she works a parttime job to help afford living.

“I also work at Boston Pizza on the weekends to help me pay for gas and food costs throughout the week.”

It’s understandable that school is important, however it becomes a tricky decision in needing to give up some personal interests and taking responsibility growing up. Work while in school is definitely recommended so you can stay on top of everything and be able to afford those personal interests while in school.

“I would recommend packing lunches instead of buying lunches at school, is also a better and affordable way of budgeting your money so you’re not seeing it disappear quickly.”

Setting yourself a budget plan is one of the best things you can do for yourself if you’re a student. It will gain you financial stability, avoid debt and set financial goals for yourself.