Money Matters

It happens every year. Students show up to school in the fall fresh from summer, happy to meet new people and ready to spend. Some students show plenty of excitement straight out of the gate by going to the bar, throwing money around and swiping away their meal plan dollars. Adam Dick, manager of the Out Back Shack said, "Students who have never lived on their own before will spend lots of money early in the term. They seem to realize pretty quickly that $1,000 will only go so far." Fast forward to Thanksgiving and because the average student doesn't have tons of extra cash to throw around, some bank accounts may begin to look empty. Sometimes the money disappears because the student didn't have a budget; they didn't have a plan.

Maybe in 25 years there will be a mandatory budgeting class in high school equivalent to English: Budgeting 101. It would be a class that everyone takes because it directly affects everyone at some point. The class would cover basics such as recording your expenses and necessities, understanding your spending habits, comparing the money coming in with the funds going out and exposing your financial equation. But until we've all taken such a class, I'd like to turn your attention to a wonderful website designed and developed by Fanshawe College staff who work hard to understand the needs of students:

www.fanshawemoney.ca

This website provides all kinds of information with respect to all things money including OSAP, bursaries, general information for parents and students, important dates to remember, financial definitions, links to every relevant student financial page - all with a Fanshawe student in mind.

However, the best feature about the site is that it has a built-in budget calculator! This tool allows to you customize the calculator for your exact needs and is very user friendly. Not to worry, all the number crunching is done automatically for you. Remember, it's fast and it's free! It took me less than 10 minutes. You can prepare your financial breakdown three ways: (The following information was taken directly from the canlearn.ca website)

1. The Education Cost Calculator estimates the cost of your post-secondary education. Taking your choice of program and all other expected costs into consideration, this tool allows you to compare up to three different options.

2. The Budget Estimator takes into consideration the money you have now and the money you expect to receive in the future. It calculates a basic balance sheet that reconciles the cost of your education and allows you to easily find out if you will be able to balance your budget.

3. The Online Budget Planner provides you with a complete working budget for your period of study.

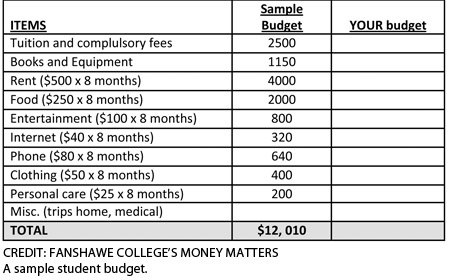

If you're more of a hard-copy kind of person and you'd rather have something tangible, take the sample budget from Fanshawe's Money Matters guide and substitute the numbers for your own. (Money Matters booklets are available online, at the Financial Aid Office, the Student Union Office or you can even grab one from Lori at the Welcome Kiosk).

The table noted below bears a striking resemblance to the one found in the Money Matters guide. Cut this copy out of the paper and use it to fill in your own values. The sample budget is just an example of about how much a student might spend on certain items throughout the school year, but fill them in as you see fit!

While not many of us are chartered accountants, payroll experts or professional bookies, these tools can aid substantially in taking charge of your finances - or at least understanding them.

Thanks to Adam Dick, the department of Awards & Scholarships and everyone at Financial Aid.

Editorial opinions or comments expressed in this online edition of Interrobang newspaper reflect the views of the writer and are not those of the Interrobang or the Fanshawe Student Union. The Interrobang is published weekly by the Fanshawe Student Union at 1001 Fanshawe College Blvd., P.O. Box 7005, London, Ontario, N5Y 5R6 and distributed through the Fanshawe College community. Letters to the editor are welcome. All letters are subject to editing and should be emailed. All letters must be accompanied by contact information. Letters can also be submitted online by clicking here.