Financial exploitation of persons with disabilities: Spotting the signs

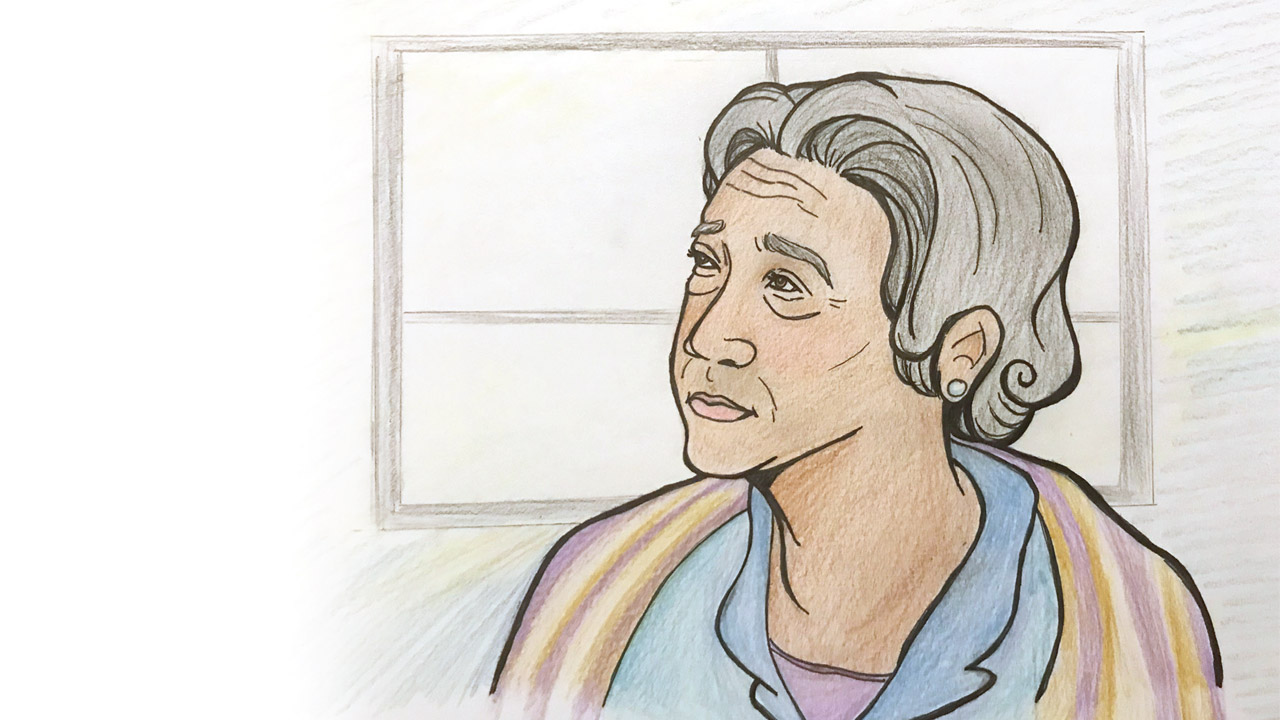

CREDIT: CHEYENNE DOCKSTADER

CREDIT: CHEYENNE DOCKSTADERPersons with disabilities (PWD) and the elderly are becoming more at risk for financial fraud due to their increased vulnerability.

Abuse comes in all forms and expression, and in the theme of this issue, we’ll be exploring financial abuse of persons with disabilities (PWD).

The Special Needs Alliance is a corporation of attorneys that represent those with special needs. The members have years of experience in this specialization and have created a website called specialneedsalliance. org to make their services more accessible and provide awareness about the rights of PWDs.

PWDs are becoming more at risk for financial fraud due to the vulnerable position they are in. Caregivers, friends, and even family members target and take advantage of a PWD through means of manipulation, convincing them to withdraw money from ATMs, forcing them to grant them financial power of attorney and even theft, according to Elizabeth L. Gray, a special needs lawyer who wrote the article “Financial abuse of individuals with disabilities.”

Through deception, manipulation, and taking advantage of those who are lonely, many have easy access to the fortunes of PWDs. Because of a person with special needs or a PWD is more easily trusting, according to Gray, they probably do not even realize that they are being targeted. Considering that the elderly may have cognitive disabilities, financial predators are more likely to select that demographic and will be less likely to get caught.

Another barrier PWDs face is communication. Some PWDs may not have the ability to relay their duress and give up because they feel like no one would believe their concerns, according to the article. If the person doing the financial exploitation is someone they rely on, the PWD may feel disinclined to communicate the abuse they are experiencing.

So, how do we spot signs of abuse? There are indeed ways to identify signs of financial exploitation experienced from the people around you according to Gray.

The individual in concern could be showing isolated behaviour. They are less inclined to participate in group gatherings and become more reluctant to talk and express feelings. The person caring for the individual in concern could be abruptly in possession of many expensive items. If you are close to the PWD, you may notice missing money, financial statements, or valuable items around the house. If the individual is spending money carelessly, providing luxurious gifts, and entrusting assets to other people, this could also indicate financial abuse. Another sign is if the PWD is late on bills, or unable to procure money for rent/mortgage and other monthly utilities. Without explanation, the finances of the individual are handled by someone else, is another indication of financial exploitation. Lastly, if the individual in concern has suddenly made changes in estate documents, then there may be financial fraud activity.

Then what do we do? If you have a person close to you that you think may be experiencing financial abuse, there are ways to get them the help they need.

Contact the Adult Protective Services (APS). In Ontario they are Adult Protective Services Association of Ontario (APSAO) and contact information can be found on their website: apsao.org.

Depending on the region you’re in, the number will be different. Getting familiar with the website and taking the steps on how to access their services will help you find the essential resources for the individual in concern. If APSAO determines that there is indeed financial abuse activity, they will arrange protective service for the individual, according to the article.

Though APSAO may not deem the individual in concern’s case as dire, there is another option to help the individual from resolving the financial abuse they are experiencing. This is done by obtaining a protective order through court, according to Gray. They will be assigned an investigator that will represent the PWD and protect them from potential abusers until the investigation is over.

To help break the cycle, try to provide education on online fraud and scams to the older adults and PWDs around you. If they are cognitively able to use devices, teach them about online safety and ensure that they are not sharing email or online financial banking passwords. Let them know that clicking on links that are sent from unknown people can potentially be scams and allow scammers to access your online information if clicked.

Financial fraud is out there, and these predators are targeting the most vulnerable demographic out there because they know they can get away with it. Taking the steps to help those around you can be the biggest change for the better in their experience of financial abuse.