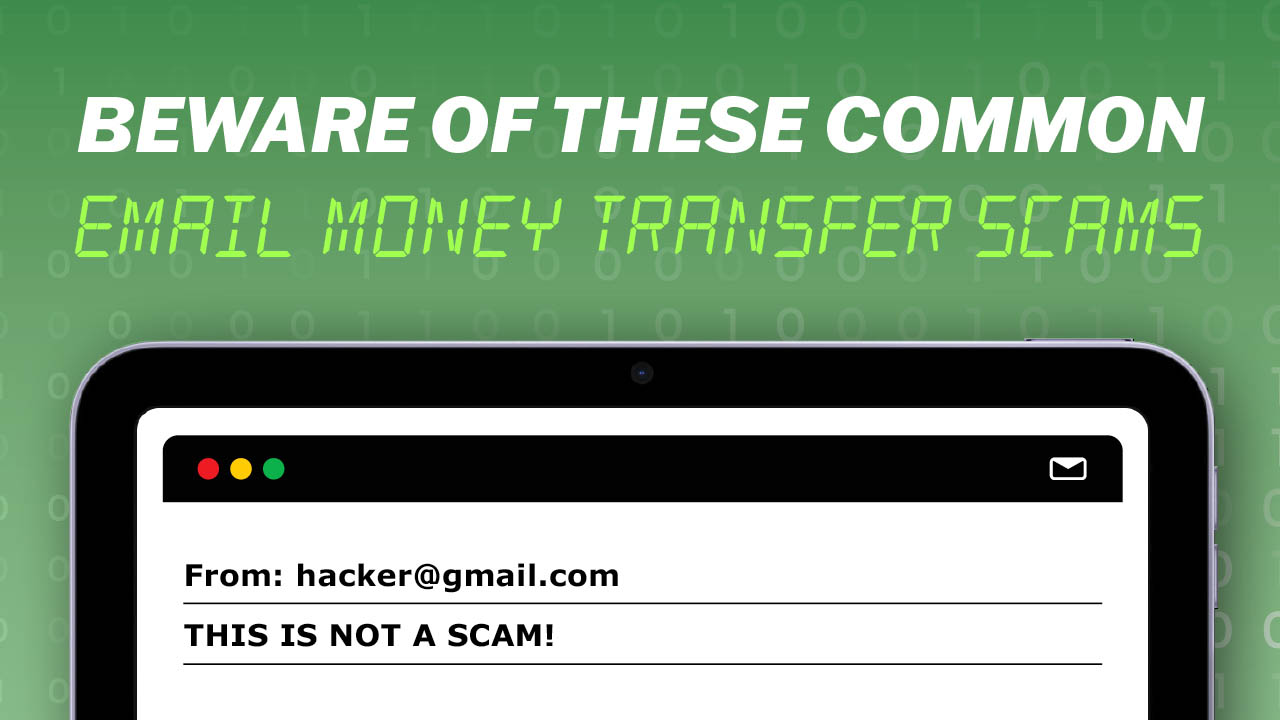

Beware of these common email money transfer scams

CREDIT: FSU PUBLICATIONS AND COMMUNICATIONS DEPARTMENT

CREDIT: FSU PUBLICATIONS AND COMMUNICATIONS DEPARTMENTInterac has made electronically sending money easier than it has ever been, and they state that $960.3 million in e-Transfers were sent in 2021.

Convenience is a driving force propelling the success of Interac. However, convenient access to electronic information is continually at odds with providing secure access.

Take Interac email money transfers as an example: the easier they make sending money, the greater the risk of unauthorized access, yet the harder they make sending money, the less appealing their service becomes.

To strike a balance between security and ease-of-access, Interac leverages the security already in place by financial institutions, and the convenience of email communication.

Despite the layers of security used for Interac email money transfers, approximately 1,800 e-Transfers totalling almost $3 million were revealed by an RCMP intelligence analyst in 2020. This amount was an increase of $400,000 from 2019.

Even in 2022, there are still ways to become a victim of email money transfer fraud.

All email money transfer scams have in common the false appearance of transaction finality. Whether you are buying or selling, you can easily become the victim of fraud if you agree to using an email money transfer for your transaction.

Here are some of the most common Interac email money transfer scams that can be easily avoided with due diligence.

As an online marketplace buyer, beware of sellers that require you to send money before you receive an item. A common scam is to request a payment for a good or service to be gained later. As a rule, do not send an email money transfer to ‘secure’ a good or service of any kind.

The most popular scams involve expensive purchases such as a rental unit, vehicle, investment.

As a buyer, there is no guarantee that you will receive what you have paid for (if you receive anything at all).

As a seller, it is risky to assume that a sent transfer indicates a successful payment. An example of a common email money transfer scam involves a buyer depositing a bad cheque, instantly receiving the money from their bank, and sending that money to the seller as payment.

Banks are quick to catch unauthorized access and reverse fraudulent email money transfers, so unauthorized transactions, whether from a hacked bank account, the use of stolen credentials, or a bad cheque deposit, can leave you not only without payment, but also without the item you ‘sold’ to a fraudulent buyer.

Some very good indicators that you are being targeted by an email money transfer scam are the same with other financial scams. Beware of transactions that are accompanied by sense of urgency, play on emotions, and a temporary inconvenience with the promise of receiving the money you sent or more.

Even if in a case where you do receive your money back, the funds could be transferred to you fraudulently and even may you a suspected accomplice in the fraud.

Finally, be very wary of email and text messages that claim you have been sent an email money transfer. Always confirm with the sender of an e-Transfer that they did in fact send it to you. The best advice for avoiding falling victim to an email money transfer scam is to simply not use them unless it is with someone close to you with whom you have an established trust.